TAILORED FINANCIAL ADVICE FOR YOUR GOALS

20 YEARS OF INDUSTRY EXPERTISE

FCA-REGULATED AND IMPARTIAL GUIDANCE

RISK TOLERANCE

It’s important to mention that there is no investment that performs in a straight line and in a consistent manner. It must fluctuate just like the economic cycle.

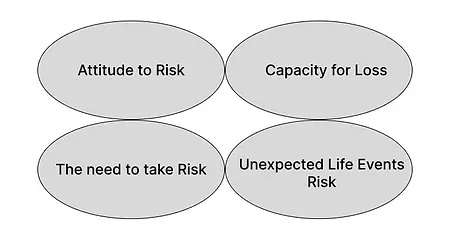

We need to establish what your understanding of investment risk is and the level of risk you are prepared to take with your investment.

This depends on four key factors.

Some of the unexpected life event risks are

-

In the event of you losing your job, which leads to accessing your investment early.

-

In the event of your premature death or becoming critically ill, which leads to crystallising your investment early.

-

In the event of unexpected expenditure, which leads to accessing your investment during adverse market conditions.

-

In the event that your elderly parents go into residential care, which leads to having time off work.

Your attitude to risk

This depends on your working life stage and investment duration (young people concentrate on building their wealth as time is on their side. Hence, they can take higher risks with their investment. Mature people concentrate on preserving their wealth, as time is not on their side and they are close to retirement age. Hence, they take lower risks with their investment.

Your capacity to take risks

This depends on how much you have as a disposable income and how much cash reserve you have before you invest. This means that the need for you to access your investment is low during adverse market conditions until the market conditions improve.

YOU NEED TO TAKE RISKS

You may not be comfortable taking any risks with your investments, but there may be a need to take some risk to meet your needs and objectives.

-

Where is your initial money invested?

-

Why does your investment fluctuate?

-

What goes on behind the scenes?

-

Who manages your investment for you?

-

What are the charges and costs that are associated with your investments?

-

What are the risks associated with your investments?

-

How have your investments been performing since inception?

WHERE IS YOUR INITIAL MONEY INVESTED? AND WHAT GOES ON BEHIND THE SCENES?

Predominantly, your initial money is invested between 4 asset classes (cash, fixed interest, commercial properties, and equities) as shown below.

High Risk

Low Risk

Commodities

Commodity investments are useful in creating a diversified portfolio, and these are sometimes known as alternative investments.

Equities/shares

Investment in equities, both in the UK and globally, has long been the cornerstone of most investment portfolios, providing long-term scope for growth of both capital and dividend income. Equity performance tends, however, to be volatile in the short term.

Hedge funds

Hedge funds are an asset that can provide returns uncorrelated to both bonds and equities. Many hedge funds are designed to capture market increases while at the same time offering protection against capital loss. These are sometimes known as alternative investments.

Commercial property

Property is an asset class that has re-established its importance in the twenty-first century. It offers the potential for long-term income and capital growth and is normally uncorrelated to equity markets.

Fixed interest (bonds)

There is a wide range of fixed interest securities from low-risk short-term government bonds to high-risk long-term corporate bonds and high-yield bonds. All these bond investments can be a useful counterbalance for equities because the performance of these two asset classes tends to have a low correlation; in other words, they do not normally move in parallel.

Cash

Cash is often perceived as a risk-free investment, but it is also a low-return investment. Historically, cash has given a return of close to zero once the impact of inflation is taken into account.

WHY DOES YOUR INVESTMENT FLUCTUATE?

This is because your investment fund has a different asset class weighting. Here, we need to understand what risk profile comfort zone to take with our investment.

The Risk Profiles

We have looked at how we can help you establish your appetite for risk, capacity to take a risk, and your need to take the risk.

These are essential steps to take before investing any money, as they help to make sure you aren’t exposed to more risk than you would like, or you’re taking enough risk to generate the returns you want within your investment timeframe. They help us to build a picture of what your risk profile looks like.

Below you’ll find examples of our six risk profiles. The explanations provided refer to typical investors and are simply intended as a guide.

Risk Averse

In general, risk-averse investors tend to prefer knowing their capital is safe, rather than seeking high returns. They may not be comfortable with the thought of investing in the stock market and prefer to keep their money in the bank.

Typically, risk-averse investors can take a long time to make up their minds on financial matters and will usually suffer from severe regret if their decisions turn out badly. This means they tend to hold all money in cash deposits. Risk-averse investors need to be aware that their unwillingness to take any risk with their money may mean that the value of their savings does not keep pace with rises in the cost of living (inflation).

Cautious Risk

In general, you want to take risks to achieve growth in excess of inflation and are willing to experience volatility and potential losses with your portfolio to achieve this. You want to avoid large swings in the value of your money; however, you are prepared to experience losses over the long term in the pursuit of growth. You are comfortable investing in stocks; however, you want to see a larger proportion of bonds, property, and fixed interest to reduce the

volatility.

Typically, Cautious investors can take some time to make up their minds on financial matters and can often suffer from regret if their decisions turn out badly.

Moderate Risk

In general, dynamic investors tend to be happy to take investment risk and understand that this is crucial in terms of generating long-term returns. They are usually willing to take a risk with most of their available assets.

Typically, dynamic investors will usually be able to make up their minds on financial matters quite quickly. While they can suffer from regret if their decisions turn out badly, they can accept that occasional poor returns are a necessary part of long-term investment.

Defensive Risk

In general, you tend to be defensive when it comes to investing, as you want to keep your money safe and avoid losses where possible. You are comfortable experiencing small amounts of volatility and a chance of some losses. You want your money to keep pace with inflation; however, you are happy to sacrifice growth to keep your money safe. You would typically have only a small proportion of your portfolio in stocks.

Typically, defensive investors can take a relatively long time to make up their minds on financial matters and will usually suffer from regret if their decisions turn out badly.

Balanced Risk

In general, you are comfortable taking risks with your money and understand that in the pursuit of long-term potential growth, volatility is a natural occurrence. Growth is a priority to you, and you are willing to risk losing money to achieve this. You tend not to make rash financial decisions and are prepared to allow time for your investment to recover should you experience losses. You are comfortable investing in stocks, which would tend to make up a noteworthy proportion of your portfolio.

Typically, Balanced investors will usually be able to make up their minds on financial matters relatively quickly but still suffer from some feelings of regret if their decisions turn out badly.

Adventurous Risk

In general, you are solely focused on growing your investment, and you are willing to experience large and frequent losses in the pursuit of the highest possible returns. You are not concerned with high levels of volatility, and look at the long-term prospects when it comes to investing. Typically, your portfolio would be invested solely in stocks with a weighting in international equities.

Typically, adventurous investors will usually make up their minds on financial matters quickly. They tend not to suffer from regret to any great extent and can accept occasional poor returns without much difficulty.

The asset allocations shown on these pages are intended to provide you with examples of how you may choose to invest. There may be more suitable asset combinations that meet your specific needs.

Fund managers will not typically hold the same investments as we’ve illustrated. Consequently, this will result in different potential for losses, volatility, and returns. Therefore, you should not take this information as an investment recommendation.

WHAT GOES ON BEHIND THE SCENES?

Predominantly, your initial money is invested between 4 pots (cash, fixed interest, commercial properties, and equities) as shown above.

The asset allocations shown on these pages are intended to provide you with examples of how you may choose to invest. There may be more suitable asset combinations that meet your specific needs.

Fund managers will not typically hold the same investments as we’ve illustrated. Consequently, this will result in different potential for losses, volatility, and returns. Therefore, you should not take this information as an investment recommendation.

Economic drivers underlying investment returns, such as economic growth, Day-to-day variability inherent in investment returns, and equity market shocks.

ASSET ALLOCATIONS

You can spread the risk with asset Diversification

Having established your risk profile, we need to establish the most effective way to invest.

Spreading risk is one of the most important principles of investing, not only between several different investment types (also known as asset classes) but also between different companies.

By taking this approach, even if a particular asset class or company goes through a bad patch, the rest of your investment need not be affected.

Deciding which asset classes to invest in to match the return you are looking for links to your chosen risk profile.

Taken together, these different asset classes could be blended to produce an asset allocation that matches your risk profile.

WHO MANAGES IT FOR YOU?

Once you have determined your risk profile, you then need to decide on the type of funds you want to invest in to achieve your financial goals. These will depend on your risk profile.

For example, someone who is risk-averse and does not want any associated risk to their capital will invest in low-risk asset classes such as cash.

Someone who has an adventurous risk profile is prepared to take a lot of risk for the potential of a greater level of anticipated return. An adventurous investor will invest in riskier asset classes such as equities, commodities, and property to achieve an asset allocation that matches that profile.

Your choice of investment fund types

Cash and cash-like funds. These funds provide lower volatility than risk-based funds, such as equities, with returns linked to the bank and building society deposit rates. There is no guaranteed capital protection.

Multi-asset Passive Management funds

These funds invest in multi-asset classes, and where some, or all, of the fund management is based on tracking a particular market or index. The fund will attempt to mirror the performance of the selected indices. Some or all of the investments are essentially run through computer programmes and therefore do not include active fund management or processes.

Multi-asset Single Manager Funds

These funds invest in multi-asset classes and funds from a single investment fund house. These funds and asset classes may be managed by a different number of specialist managers within that single investment fund house or the individual’s single manager. The fund may either directly invest across different asset classes or be created through blending single-managed funds from within that fund house. In each case, the manager blends them to meet a specific risk profile and asset allocation. This manager is responsible for actively managing the asset allocation and achieving the performance expected.

Multi-asset Multi-Manager funds

A multi-manager is a specialist who selects a blend of single-managed funds from the whole of the market and blends them to meet a specific risk profile and asset allocation. This multi-manager is responsible for actively managing the asset allocation and achieving the performance expected. This includes the use of other funds and other managers. The multi-manager will switch between funds and sectors in response to market changes, research, and analysis. This approach involves making decisions on the inclusion and exclusion of funds against risk profiles, intending to reduce volatility. These funds aim to give the investor access to a wide range of different fund managers and asset types through a single investment fund. The funds are typically managed by a dedicated manager or specialist teams who scour the industry to select the managers they expect to deliver good returns.

Discretionary Fund Management

Discretionary fund management consists of a portfolio of investment vehicles rather than a fund-of-funds approach and is often considered more personal to the needs of the individual client. A discretionary fund manager will construct a portfolio of varying assets and investment types based on a client’s attitude to risk and agreed investment strategy. The discretionary fund manager is responsible for switching between funds and sectors in response to market changes, research, and analysis. They will rebalance portfolio assets in line with the agreed strategy as and when deemed appropriate. There is normally a minimum overall investment value needed for this service.

Past performance is not a guide to future performance.

TESTIMONIALS